Excitement About G. Halsey Wickser, Loan Agent

Table of ContentsG. Halsey Wickser, Loan Agent - An OverviewThe Main Principles Of G. Halsey Wickser, Loan Agent The Facts About G. Halsey Wickser, Loan Agent RevealedSome Known Factual Statements About G. Halsey Wickser, Loan Agent Indicators on G. Halsey Wickser, Loan Agent You Need To Know

When functioning with a home mortgage broker, you ought to clarify what their cost framework is early on in the process so there are no shocks on closing day. A home mortgage broker generally just obtains paid when a finance closes and the funds are released.The bulk of brokers do not cost debtors anything in advance and they are generally risk-free. You must make use of a home mortgage broker if you intend to discover access to mortgage that aren't readily advertised to you. If you do not have outstanding credit scores, if you have an unique borrowing situation like having your own organization, or if you simply aren't seeing home loans that will work for you, after that a broker could be able to get you access to car loans that will certainly be beneficial to you.

Home loan brokers may also have the ability to assist loan hunters receive a lower passion rate than a lot of the commercial finances provide. Do you need a home loan broker? Well, functioning with one can save a borrower time and effort throughout the application procedure, and potentially a great deal of money over the life of the financing.

The Best Guide To G. Halsey Wickser, Loan Agent

A professional home mortgage broker originates, discusses, and refines property and industrial home loan financings on behalf of the customer. Below is a 6 factor overview to the services you need to be offered and the expectations you should have of a professional home mortgage broker: A home loan broker supplies a large range of home loan from a number of various lenders.

A home loan broker represents your interests instead of the interests of a loan provider. They should act not just as your agent, yet as a well-informed specialist and problem solver - mortgage loan officer california. With accessibility to a vast array of home mortgage items, a broker is able to provide you the best value in regards to rates of interest, payment quantities, and funding items

Many circumstances demand greater than the basic usage of a three decades, 15 year, or adjustable price mortgage (ARM), so innovative home loan methods and advanced services are the advantage of collaborating with a seasoned home mortgage broker. A home loan broker navigates the customer via any situation, dealing with the procedure and smoothing any type of bumps in the roadway along the road.

Unknown Facts About G. Halsey Wickser, Loan Agent

Customers that find they need bigger lendings than their financial institution will certainly authorize also gain from a broker's expertise and capability to efficiently obtain funding. With a home loan broker, you only need one application, instead than finishing types for each and every individual lending institution. Your home mortgage broker can provide an official contrast of any kind of financings recommended, leading you to the details that properly depicts expense differences, with current prices, points, and closing expenses for every loan reflected.

A trustworthy home loan broker will divulge how they are paid for their solutions, as well as information the overall expenses for the loan. Customized solution is the setting apart variable when choosing a mortgage broker. You need to expect your home loan broker to assist smooth the means, be readily available to you, and suggest you throughout the closing process.

The trip from fantasizing concerning a brand-new home to in fact possessing one might be full of obstacles for you, especially when it (https://www.startus.cc/company/g-halsey-wickser-loan-agent) involves securing a mortgage in Dubai. If you have actually been thinking that going directly to your bank is the most effective course, you may be losing out on a simpler and possibly a lot more useful option: functioning with a home loans broker.

Facts About G. Halsey Wickser, Loan Agent Revealed

Among the substantial advantages of utilizing a home mortgage professional is the professional economic advice and necessary insurance guidance you get. Mortgage specialists have a deep understanding of the different monetary items and can help you pick the right home mortgage insurance policy. They make sure that you are sufficiently covered and supply advice tailored to your monetary situation and long-term goals.

This procedure can be difficult and taxing for you. A mortgage brokers take this concern off your shoulders by managing all the documents and application processes. They understand specifically what is called for and guarantee that everything is finished accurately and on time, decreasing the threat of hold-ups and errors. Time is cash, and a home loan broker can conserve you both.

This indicates you have a better opportunity of discovering a home mortgage funding in the UAE that flawlessly matches your demands, including specialized items that could not be readily available via conventional banking networks. Browsing the mortgage market can be complex, particularly with the myriad of products available. A supplies specialist assistance, aiding you understand the benefits and drawbacks of each option.

What Does G. Halsey Wickser, Loan Agent Do?

This specialist advice is indispensable in securing a home loan that straightens with your financial objectives. Home mortgage advisors have actually established connections with many lenders, providing them considerable discussing power.

Molly Ringwald Then & Now!

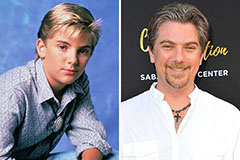

Molly Ringwald Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!